Inflation During the Pandemic: Is ‘Transitory’ a Myth?

As the pandemic continues to hamper our economy and the Russia-Ukraine war creates turmoil in energy markets, “Great Inflation” rhetoric has seeped back into our global vocabulary. In March 2022, US inflation as measured by the consumer price index (CPI) rose 8.5%—the fastest pace in nearly four decades [1]. Similarly, the UK’s CPI rose by 7% [2]. This represented a blow to the US Federal Reserve, which quickly relinquished its characterization of inflation as “transitory.” [3] While this article is centered on the US, the analysis remains relevant to the world’s advanced economies, who are all feeling the inflationary upturn.

Though the current uptick in inflation is worryingly reminiscent of the high inflation of the 1970s, soaring prices now are driven by the confluence of surging demand and supply chain disruptions [4]. As the pandemic and war continue to the detriment of our economy, the best approach is to carefully tighten monetary policy, open our economy, and engage supply-side policies, paving the way for long-term economic growth.

Inflation is at a level we have not had to grapple with for decades, but we must first consider base effects, which are perhaps the most intuitive reasons for current inflation. The Covid-19 pandemic plunged the world economy into its deepest recession since the Second World War, and higher inflation last year was reflected against the worst of the pandemic [5]. This statistical quirk does lend credence to the short-term inflation argument, since a year-on-year comparison was always going to look outlandish.

Cost-push Inflation: The Troubling Effect of a Global Pandemic

The main determinant of cost-push inflation has been high commodity prices linked to supply chain bottlenecks caused by the pandemic. Widespread shortages and supply chain disruptions have led to higher inflation for goods rather than services [6]. Intense supply disruptions in the automotive sector have propelled inflation, as the price of second-hand cars and fuel went up by an annual rate of more than 20% [7]. Still, as economies slowly open up, these kinks may soon abate by themselves.

CPI inflation, however, is expected to continue rising as the Russia-Ukraine war adds additional upward pressure on already high energy and food prices. China’s “zero-Covid” lockdowns also continue to intensify supply chain problems [8]. In contrast, the New York Fed’s new Global Supply Chains Pressure Index indicates that on average, backlogs and general disruptions have been improving [9]. With the energy index at an annual gain of 34.6%, soaring energy prices will likely encourage countries to adopt a supply-side approach to tackle inflation [10].

Cost-push inflation has also been driven by the startling labor shortage, as evidenced by declining employment rates. In the US, even though unemployment fell to just 3.9% in December last year, there are now 2.6 million private jobs vacant since February 2020, leaving employers scrambling for workers [11]. This means many businesses are unable to run at full capacity. Businesses are also inclined to increase wages to attract and retain whatever labor is left. In part, therefore, current inflation reflects rising costs and wages despite limited demand in the services sector [12].

Overheated Demand

While supply-side factors have contributed significantly to current global inflation, the sharp increase in global demand has also driven soaring prices [13]. During the pandemic, governments, particularly the US, have responded with lavish stimulus payments and corporate bond-buying, while central banks worked to induce liquidity by keeping interest rates low [14]. As a result, the personal savings rate quadrupled in the United States, with consumers worldwide taking away around $5.4 trillion USD in excess savings[15, 16].

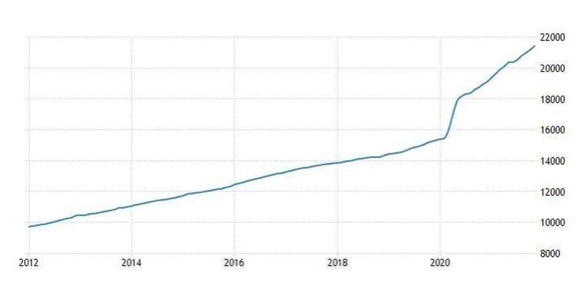

One yardstick that many view as the root of inflation is the 40% spike in money supply, which is the total volume of money held by the public since the pandemic struck (see Figure 1).

Figure 1: M2 money supply in the US economy, as measured in billions [17].

In the words of Milton Friedman, “Inflation is always and everywhere a monetary phenomenon.” [18] As monetarists hold, inflation is a function of money supply multiplied by the velocity of money; the “…frequency at which one unit of currency is used to purchase domestically-produced goods and services within a given period.” [19] The steep decline in the velocity of money since the start of the pandemic suggests two things: the booming money supply was a major contributor to inflation, and the tapering of emergency support by governments worldwide will accelerate disinflation further into 2022 [20].

An Inflation Problem Like No Other

When inflation is driven by demand, monetary policy helps stabilize the economy. To achieve a long-term inflation rate of 2%, central banks will have to step off the gas—raising rates and tapering stimulus and not slamming too hard on the brakes lest this leads to recession. When soaring prices are compounded by the collision of pent-up demand and restricted supply, however, monetary policy is simply too blunt an instrument—incapable of surgical precision.

The current energy crisis provides a strong rationale for a shift in energy policies. Countries may find it prudent to lift restrictions and invest in renewable energies, strengthening against future disruptions and paving the way for lower energy costs [21]. This supply-side approach might help us promote a return of activity, boosting long-term productivity without letting Covid-19 maintain its chokehold on the economy.

Most urgently, rising energy and food bills are leading to severe belt-tightening among households. While American consumers hold about $2.5 trillion in excess savings, most of that is concentrated among richer households, leaving lower-income households less able to brave the soaring prices [22]. As governments tackle inflation, better support targeted at households with little savings, in terms of rebates or subsidies, is needed.

If we play it right, as supply chain disruptions and overheated demand ease, and the transitory drivers of inflation fall away, we might just see a return to normalcy.

References

Photo by Krzysztof Hepner on Unsplash

[1] Jeanna Smialek, “Inflation Hits Fastest Pace Since 1981, at 8.5% Through March,” The New York Times, 2022, accessed April 10, 2022, https://www.nytimes.com/2022/04/12/business/economy/inflation-report-march.html.

[2] Office for National Statistics, “Consumer price inflation, UK: March 2022,” Gov.uk, 2022, accessed May 31, 2022, https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/march2022.

[3] Rich Miller, “Jerome Powell Ditches ‘Transitory’ Tag, Paves Way for Rate Hike,” Bloomberg, 2021, accessed February 7, 2022, https://www.bloomberg.com/news/articles/2021-11-30/powell-ditches-transitory-inflation-tag-paves-way-for-rate-hike.

[4] Chotibhak Jotikasthira, Anh Le, and Christian T. Lundblad, “Why Do Term Structures in Different Currencies Comove?” Journal of Financial Economics (JFE), Forthcoming, UNC Kenan-Flagler Research Paper No. 2013-11.

[5] M. Ayhan Kose, Franziska Ohnsorge, and Naotaka Sugawara, “A Mountain of Debt : Navigating the Legacy of the Pandemic,” Policy Research Working Paper;No. 9800, World Bank (2021).

[6] Valentina Romei, “UK inflation rises to highest level since 2011,” Financial Times, 2021, accessed February 7, 2022, https://www.ft.com/content/1d3d1cfb-e0af-42db-b1d8-1f601854ea8d.

[7] M. Ayhan Kose, Franziska Ohnsorge, and Naotaka Sugawara, “A Mountain of Debt : Navigating the Legacy of the Pandemic,” Policy Research Working Paper;No. 9800, World Bank (2021).

[8] Jeremy Weltman, “ECR survey results Q1 2022: War and inflation upset global risk metrics,” Euromoney Country Risk, 2022, accessed April 14, 2022, https://www.euromoneycountryrisk.com/article/b1xlv675kwvmhc/ecr-survey-results-q1-2022-war-and-inflation-upset-global-risk-metrics.

[9] Gianluca Benigno, Julian di Giovanni, Jan J. J. Groen, et al., “A New Barometer of Global Supply Chain Pressures,” Liberty Street Economics, 2022, accessed February 7, 2022, https://libertystreeteconomics.newyorkfed.org/2022/01/a-new-barometer-of-global-supply-chain-pressures/.

[10] Colby Smith, and Eric Platt, “US unemployment rate drops to 3.9% giving Fed ammunition to raise rates,” Financial Times, 2022, accessed February 7, 2022, https://www.ft.com/content/d26ccd56-ebb9-43a8-b6b1-ff8361ca9876.

[11] “Consumer Price Index Summary,” U.S. Bureau of Labor Statistics, 2022, accessed June 21, 2022, https://www.bls.gov/news.release/cpi.nr0.htm.

[12] Chris Giles, “UK inflation jumps to highest level in 30 years,” Financial Times, 2022, accessed February 7, 2022, https://www.ft.com/content/9188e191-4c1c-4968-a3af-9a43f086de6b.

[13] Jongrim Ha, M. Ayhan Kose, and Franziska Ohnsorge, “Inflation During the Pandemic: What Happened? What is Next?” Social Science Research Network.

[14] Eric Milstein, David Wessel, Jeffrey Cheng, et al., “What did the Fed do in response to the COVID-19 crisis?” Brookings, 2021, accessed February 7, 2022, https://www.brookings.edu/research/fed-response-to-covid19/.

[15] Rick Babson, “Study shows surge in savings during the pandemic,” Federal Reserve Bank of Kansas City, 2021, accessed February 7, 2022, https://www.kansascityfed.org/ten/2021-spring-ten-magazine/study-shows-surge-in-savings-during-the-pandemic/.

[16] Hanna Ziady, “Consumers have $5.4 trillion in excess savings. That could unleash a global spending boom,” CNN Business, 2021, accessed February 7, 2022, https://edition.cnn.com/2021/04/19/business/consumer-saving-spending-boom/index.html.

[17] “M2 (M2SL),” Federal Reserve Bank of St. Louis, 2022, accessed February 7, 2022, https://fred.stlouisfed.org/series/M2SL.

[18] Milton Friedman, “The Counter-Revolution in Monetary Theory,” Institute of Economic Affairs, 1970, accessed February 7, 2022, https://miltonfriedman.hoover.org/objects/56983/the-counterrevolution-in-monetary-theory.

[19] “Velocity of M2 Money Stock (M2V),” Federal Reserve Bank of St. Louis, 2022, accessed February 7, 2022, https://fred.stlouisfed.org/series/M2V.

[20] Jeff Cox, “Powell says Fed will discuss speeding up bond-buying taper at December meeting,” CNBC, 2021, accessed February 7, 2022, https://www.cnbc.com/2021/11/30/powell-says-fed-will-discuss-speeding-up-bond-buying-taper-at-december-meeting.html.

[21] Isabel Schnabel, “A new age of energy inflation: climateflation, fossilflation and greenflation,” European Central Bank, 2022, accessed April 10, 2022, https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp2203172~dbb3582f0a.en.html.

[22] Fisher, J. D., Johnson, D.S., Smeeding, T. M and Thompson, J. P., “Estimating the marginal propensity to consume using the distributions of income, consumption, and wealth”, Journal of Macroeconomics, Vol. 65, 2020.

Is the Estonian e-residency program a digital fairytale?

Estonia is considered a role model for digital public administration. The Estonian e-residency program is the most recent e-government initiative, which promises entrepreneurs worldwide access to its public administration 24/7. In its current state, the program cannot achieve its ambitious goal due to structural misconceptions that have caused issues around its efficiency and inclusiveness.

School Choice in the United States

School choice encompasses a variety of programs run by the U.S. government that allows parents to choose a school other than their local publicly funded school. Wealthy parents have been able to afford choices in education for a very long time. Now it is time that we allow poorer citizens to choose an education that best fits the needs of their children. School choice will allow this to happen.

U.S. vs. China? Cooperation in Telecommunications in East Africa

Some Western political strategists suggest a “Tech Cold War” is playing out in Africa between China and the U.S. Based on case studies from Ethiopia and Kenya, this perspective neglects the actual state of affairs. Instead of searching for “China-free” actors, the West should take the rationale of each project as a yardstick to stay engaged and relevant in the emerging African information and communications technology sector.