Public Credit Scores – A Weapon Against Debt Accumulation?

Debt fueled consumption lay at the heart of the global financial crisis of 2008, as widespread defaults on subprime American household loans initiated a cascade of financial defaults worldwide. Nearly ten years later, household debt – fueled by conspicuous consumption – remains a major problem in developed economies.

Neoclassical economic theory assumes that consumption happens in a vacuum. But what early economist Adam Smith and sociologist Thorstein Veblen recognized is that consumption is influenced by social relations. The desire to maintain or improve one’s social standing can lead to wasteful and socially harmful behavior. Today, this is known as “competitive” or “conspicuous” consumption.

In her book The Overspent American, Professor Juliet Schor elegantly described how competitive consumption leads to the paradox of undermining everyone’s wellbeing: “[…] competitive consumption creates a ‘prisoner’s dilemma’ […] If the Joneses could be induced not to upgrade their car or house or whatever, then the Smiths wouldn’t have to either, and both would be happier.” [1]

Conspicuous consumption leads to an “arms race” in status acquisition, the potential consequence being a decline in the financial position of those involved.[2] Indeed, competitive consumption has long concerned economists because it represents a zero-sum game: one person’s gain in status invariably means another person’s loss in status.

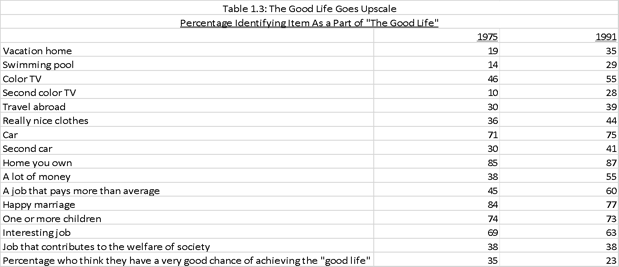

The rise of conspicuous consumption can be seen in data from Schor in the table below noting how goods once classed as “luxuries” are now deemed “essentials.”[3]

SEQ Figure \* ARABIC 2: Schor (1998)

Consumption is normally the largest portion of GDP. While it is true that we consume to live, it is also true that we consume to project a certain image of ourselves to others. This was seen in the run-up to the financial crisis of 2007-2008, where, aided in an environment of low interest rates and other unwise policy decisions, many chose to take out mortgages in pursuit of the “American Dream.”

One study by Lee, Mori, and Qian looking at a dataset for the Singaporean economy found that “status-seeking-induced conspicuous consumption is an important determinant of household indebtedness.”[4] They went on to add that, unlike traditional economic theory, liquidity constraint is not the only determinant of household indebtedness: social influences play a part as well.

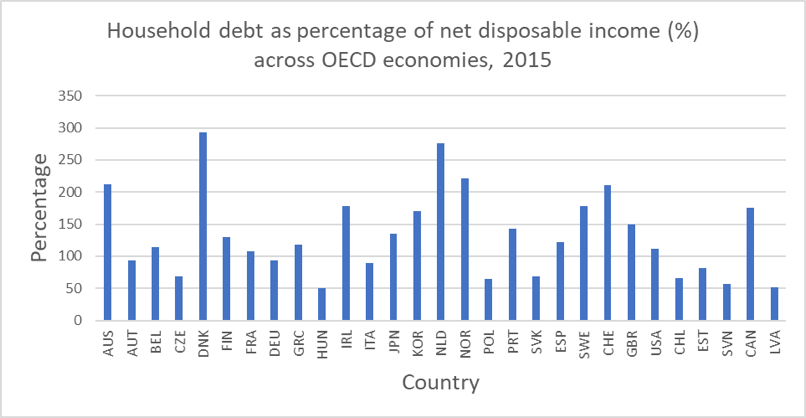

Figure 1: OECD (2017)[5]

In her book, Professor Schor hinted at a solution to competitive consumption: individuals need to be incentivized by “a central coordinating entity – like the government.”[6] This could mean imposing a tax on luxury goods, for example, to correct for the negative externality associated with status acquisition. Both Pigou and Mill supported this, and Schor pithily wrote that “consumption taxes are a start.”[7]

But there is perhaps a simpler and more effective way to discourage conspicuous consumption: making everyone’s credit score public.

Although luxury taxes can sometimes be effective policy instruments against conspicuous consumption, they are also constrained by the bureaucracy that comes with their implementation. Trends in luxury goods come and go so often that taxation rules would continually need to change – an unreasonable task. Furthermore, the efficacy of a luxury tax depends upon the price elasticity of demand: in fact, from a purely a theoretical standpoint, such a tax may have the inadvertent consequence of increasing demand thereby encouraging conspicuous consumption.

Conspicuous consumption across many advanced economies today is underpinned by asymmetric information: we consume to convey an image of ourselves to others not necessarily reflective of our true wealth. Many go into debt purchasing status goods to portray an image of themselves inconsistent with their actual financial position.

Like the classical case of asymmetric information put forward by Akerlof,[8] society is arranged in such a way that people are incentivized to take on debt in order to maintain their status. This results in “lemons” – that is, those heavily indebted – enjoying privileges denied to the frugal: lemons get nods of approval in the streets, more attention from potential romantic partners, and in some cases even improved employment prospects.[9] We tend to think the wealthy spend a lot on luxury goods, yet Schor, referring to Stanley and Danko, noted that they found that “most millionaires live frugal lives – buying used cars, purchasing their suits at JC Penney, and shopping for bargains.”[10]

Making people’s credit score publicly available would address the asymmetry of information that currently exists with respect to status: those living beyond their means would be quickly exposed as “lemons” or “posers,” while the prudent would be rewarded with public acknowledgment of their financial responsibility. Governments could implement the policy by launching a web portal displaying a person’s average credit score from the leading credit rating agencies. An individual’s score could then be accessed by simply typing in their name.

Conspicuous consumption is still today a significant determinant of household debt – a major problem for any economy. The current system rewards the profligate and penalizes the frugal. But making individual credit scores public would turn this on its head, encouraging financial responsibility and redressing the unfairness of a system built on credit.

References

[1] Juliet B, Schor, The Overspent American: Upshifting, Downscaling And The New Consumer, 1st ed. (New York, NY: Basic Books, 1998).

[2] This arms race also has the consequence of producing a “hedonic treadmill,” where gains in income lead to no gains in happiness. This is evidenced, among many other things, from the rise in the median response among American households on how much income they need to fulfil the “American Dream”: from $50,000 in 1987 to $90,000 in 1996, constant prices. See Schor (1998).

[3] Schor, 1998, The Overspent American.

[4] Kwan Lee, Masaki Mori, and Wenlan Qian, “Conspicuous Consumption And Household Indebtedness,” 2017, accessed October 26, 2017, https://pdfs.semanticscholar.org/70bb/8edcac8802816fbfe90e7c1643d67419dd34.pdf

[5] OECD, Household debt (indicator), 2017, accessed on October 26, 2017, doi: 10.1787/f03b6469-en.

[6] Schor, The Overspent American.

[7] Ibid.

[8] George Akerlof, “The Market For “Lemons”: Quality Uncertainty And The Market Mechanism,” The Quarterly Journal Of Economics 84, no. 3 (1970): 488. doi:10.2307/1879431.

[9] In their draft study Conspicuous Consumption and Household Indebtedness, Lee, Mori and Qian noted in the dataset they analyzed that young Singaporean males were more likely than other demographic groups to take on debt to engage in status-seeking behavior. This may be explained in part as an effort to attract women, as research suggests women are in many countries, on average, more attracted to men with wealth. Cf. Stanford Graduate School of Business. 2014. Professor Paul Oyer: The Economics Of Dating, Job Hunting, And More. Video. https://www.youtube.com/watch?v=LmhILSGA2bA&t=2324s.

[10] Schor, The Overspent American; Thomas J Stanley and William D Danko, The Millionaire Next Door (New York: Pocket Books, 1998).

Is the Estonian e-residency program a digital fairytale?

Estonia is considered a role model for digital public administration. The Estonian e-residency program is the most recent e-government initiative, which promises entrepreneurs worldwide access to its public administration 24/7. In its current state, the program cannot achieve its ambitious goal due to structural misconceptions that have caused issues around its efficiency and inclusiveness.

School Choice in the United States

School choice encompasses a variety of programs run by the U.S. government that allows parents to choose a school other than their local publicly funded school. Wealthy parents have been able to afford choices in education for a very long time. Now it is time that we allow poorer citizens to choose an education that best fits the needs of their children. School choice will allow this to happen.

Inflation During the Pandemic: Is ‘Transitory’ a Myth?

Caused by pent-up demand and intense supply disruptions, inflation has risen to its highest level in decades. As the specter of “entrenched inflation” looms, central banks must use monetary policy sensibly without overreacting. Central banks should allow time for overheated demand and supply disruptions to ease, lest the world’s advanced economies face their hardest landing yet.